The dollar index remains below 100.00 level on Monday

- During the Asian session, the dollar index failed to break above the 100.00 level.

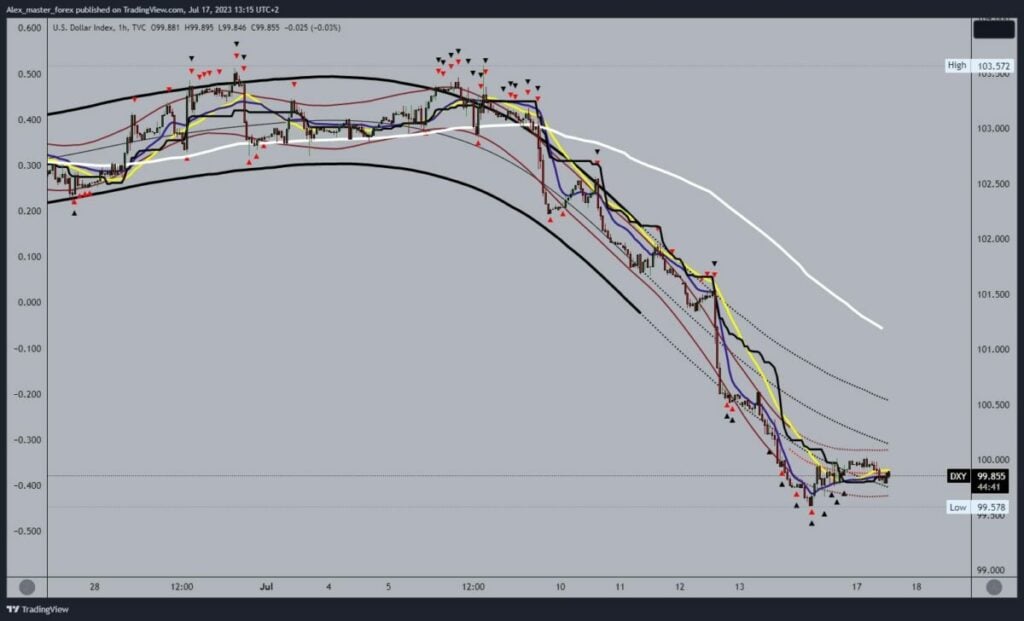

Dollar index chart analysis

During the Asian session, the dollar index failed to break above the 100.00 level. We saw a pullback to the 99.80 support level and are managing to hold above it for now. Last week’s report on slowing inflation pushed the dollar below the 100.00 psychological level.

Today, we see an attempt to recover and return above the 100.00 level. If we succeed in that, we will have a solid opportunity to initiate a more concrete recovery of the dollar. Potential higher targets are 100.20 and 100.40 levels. Such a move could make this week positive for the dollar index.

We need a negative consolidation and pullback to the previous support at the 99.58 level for a bearish option. A drop below it would indicate a continuation of the weak dollar and its decline. Potential lower targets are 99.40 and 99.20 levels.

This week’s news that could affect the dollar the most is the UK and EU CPI report, which will decide future UK and EU monetary policy. Therefore, strong European currencies will influence the dollar to continue to weaken. FROM US news, we will single out Retail Sales, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, and Existing Home Sales. This week will be interesting for the dollar index.

The post The dollar index remains below 100.00 level on Monday appeared first on FinanceBrokerage.